Concerns about visa regulations are on the rise while marketing has become the least of worries for travel businesses, according to findings of WYSE Travel Confederation’s May edition of the COVID-19 Travel Business Impact Survey.[1] In their search for new sources of business, it appears that many are looking for new modes of collaboration, and respondents also expressed greater satisfaction with partner cooperation in May compared with April. Volunteer and educational travel businesses were the most satisfied with partner cooperation. The deepening crisis is reflected in rising requests for financial assistance, up from 28% of respondents in April to 43% of respondents in May. Business is also moving online, particularly in the education and language learning fields, and investment in online communication tools and employee training have risen, suggesting that businesses are adapting to new conditions of operation.

Concerns

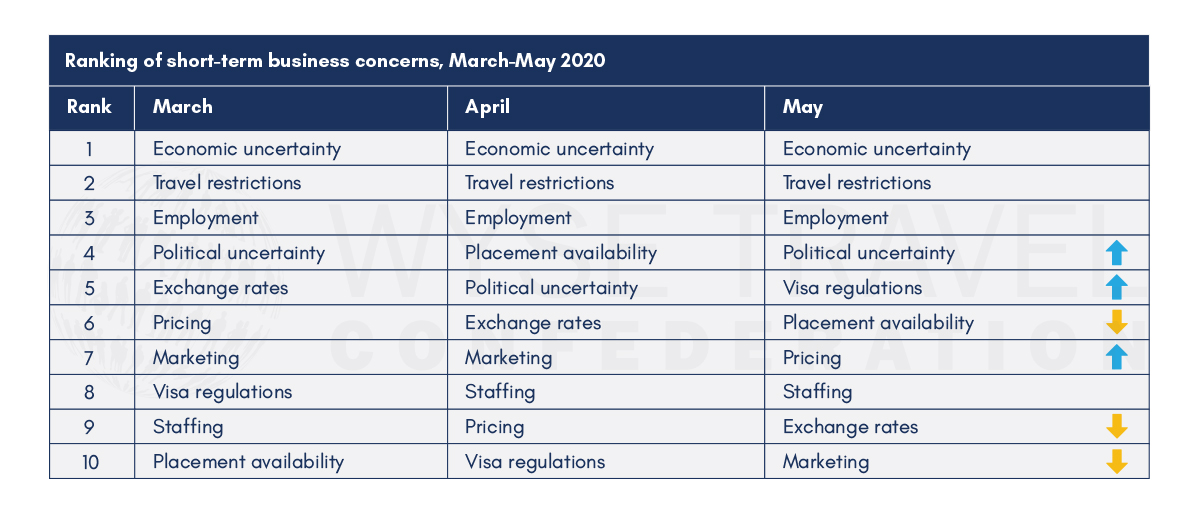

Economic uncertainty, travel restrictions, political uncertainty and employment topped the business concerns in May for both the short- and long-term. While there does not seem to be much concern with marketing, issues such as visa regulations, placement availability and pricing hovered at the middle of the top ten concerns for travel businesses.

Over the three waves of the survey, there has been little change in both the top short- and long-term concerns for travel businesses. However, short-term concerns about visa regulations rose notably in May, whereas exchange rates became less of a concern. Marketing was the least important of short-term concerns for businesses in May.

Again, the long–term concerns have remained similar to short–term concerns and relatively stable across the three waves of the survey. Marketing, just as for the short-term, dropped down the list of long-term business concerns. This tendency to make significant cuts to marketing during financial crisis was also picked up during the global economic downturn of 2008 – 2010 by WYSE Travel Confederation’s Youth Travel Monitor survey. The nature of the COVID-19 pandemic is of course different than an economic crisis in that travel restrictions mean very few travellers to market travel products to. The importance of product marketing is therefore logical for the short term, though some destinations have recently invested in ‘visit later’ marketing campaigns, encouraging potential visitors to keep travel in mind for a later date. The health and safety messaging that many operators will likely focus on communicating as travel resumes, could potentially be viewed as marketing and begin to push marketing back up in the ranking of business concerns. Standards for hygiene and safety protocols will be particularly important for providers of accommodation, tours, activities and attractions to communicate to both travellers and business partners. The role that Online Travel Agents (OTAs) may play in these communication activities remains to be seen.

Actions taken

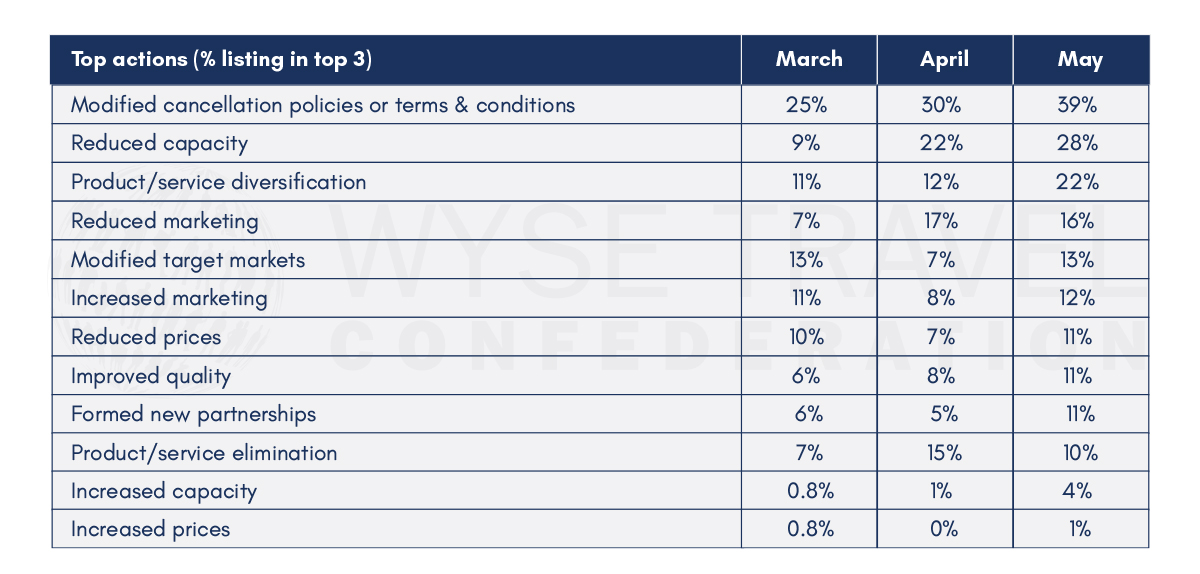

Since the start of the survey in March, the most frequent action taken by travel companies has been the modification of cancellation policies. This has also grown in importance over time. However, as of May there were more moves to cut capacity and diversify product offering. Very few respondents increased capacity or prices, but there are some signs that capacity is being added in anticipation of easing of travel restrictions. It is also clear that the number of actions being taken overall is growing as the crisis deepens. More businesses now seem to be forming new partnerships in attempts to weather the storm.

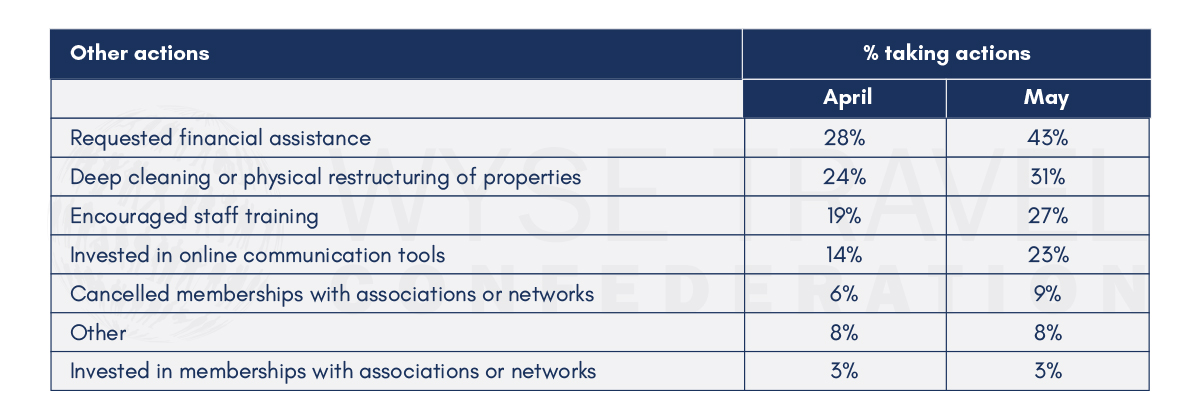

The other actions taken most frequently by travel businesses included requesting financial assistance, which rose from 28% of respondents in April to 43% of respondents in May. Investment in online communication tools also rose, along with encouraging employee training. Such actions seem logical with educational travel experiences moving to online environments and the need for hospitality providers to implement new health and safety protocols. There was no change to the investment in membership with associations or networks, however there was an increase in cancellation of such memberships.

Collaboration

In seeking new opportunities, collaboration with business partners seems to have become more important. A greater proportion of respondents commented on collaboration in May than in April.

Amidst a climate of increasing collaboration, just under half the respondents indicated they had experienced some kind of partner dispute as a result of the COVID-19 crisis. However, the proportion of organisations reporting disputes fell slightly between April and May. This may indicate that there is a concerted effort to find successful mechanisms to resolve disputes or that disputes have been resolved by indirect means, such as business closures. Most disputes were financial, with refunds and cancellations being the issues causing most friction, followed by payments.

In general, the climate of B2B collaboration has remained similar throughout the pandemic thus far, with a rise in respondents indicating that collaboration is the same, and fewer respondents saying it had become worse.

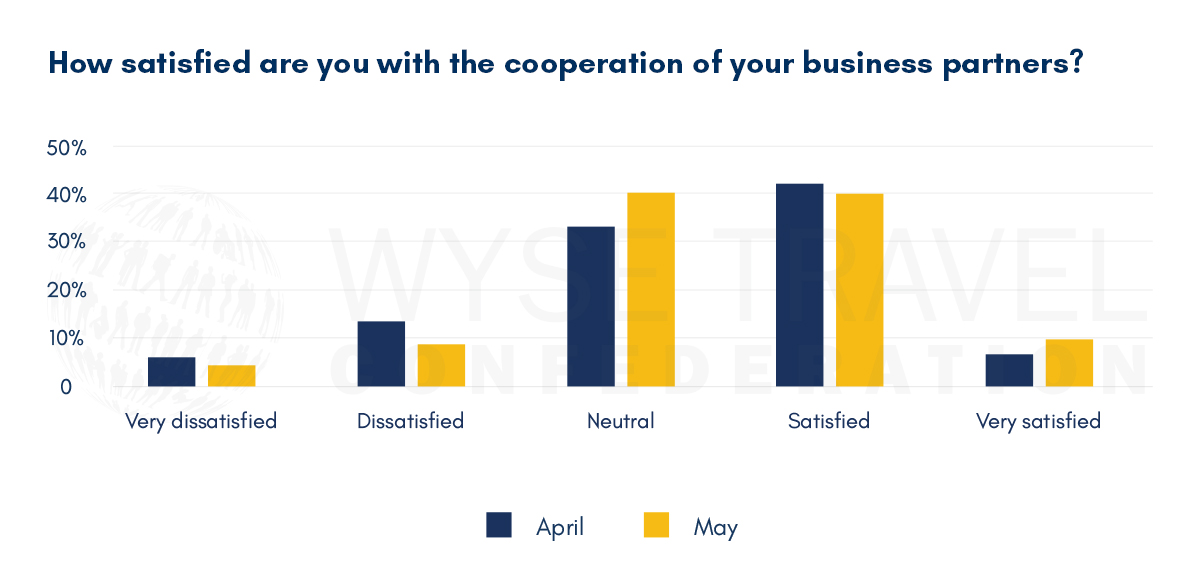

The levels of satisfaction with the cooperation of business partners rose slightly in May compared with April.

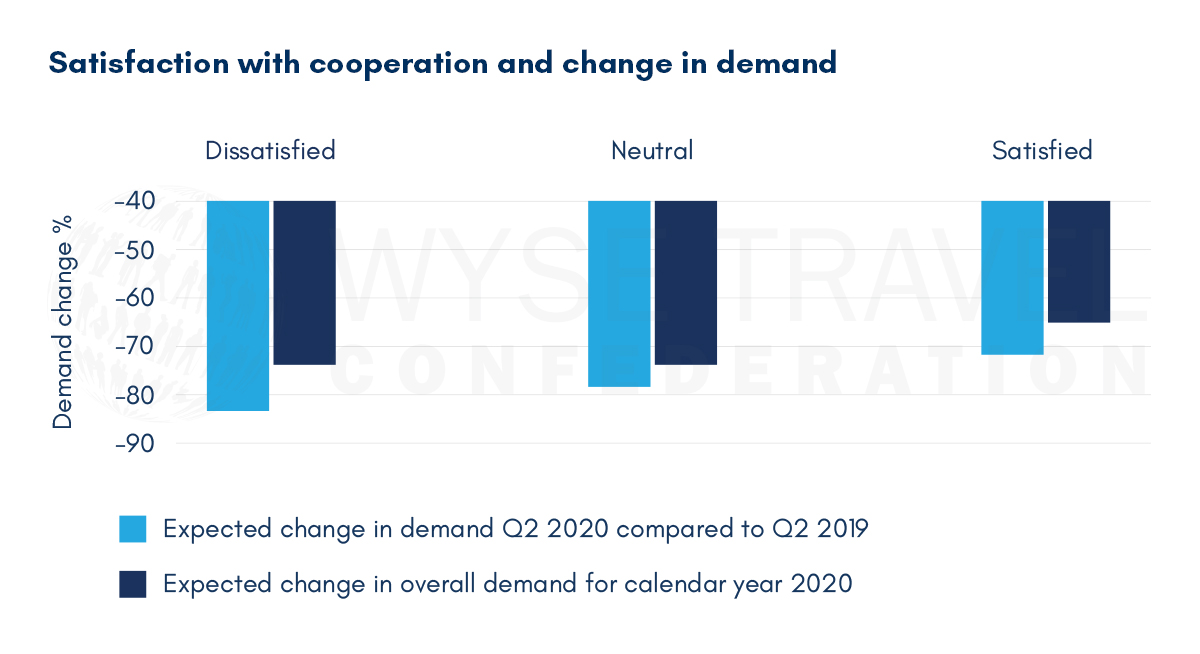

There appears to be a direct relationship between change in demand and satisfaction with cooperation, which may indicate that better cooperation leads to better results and/or higher expectations.

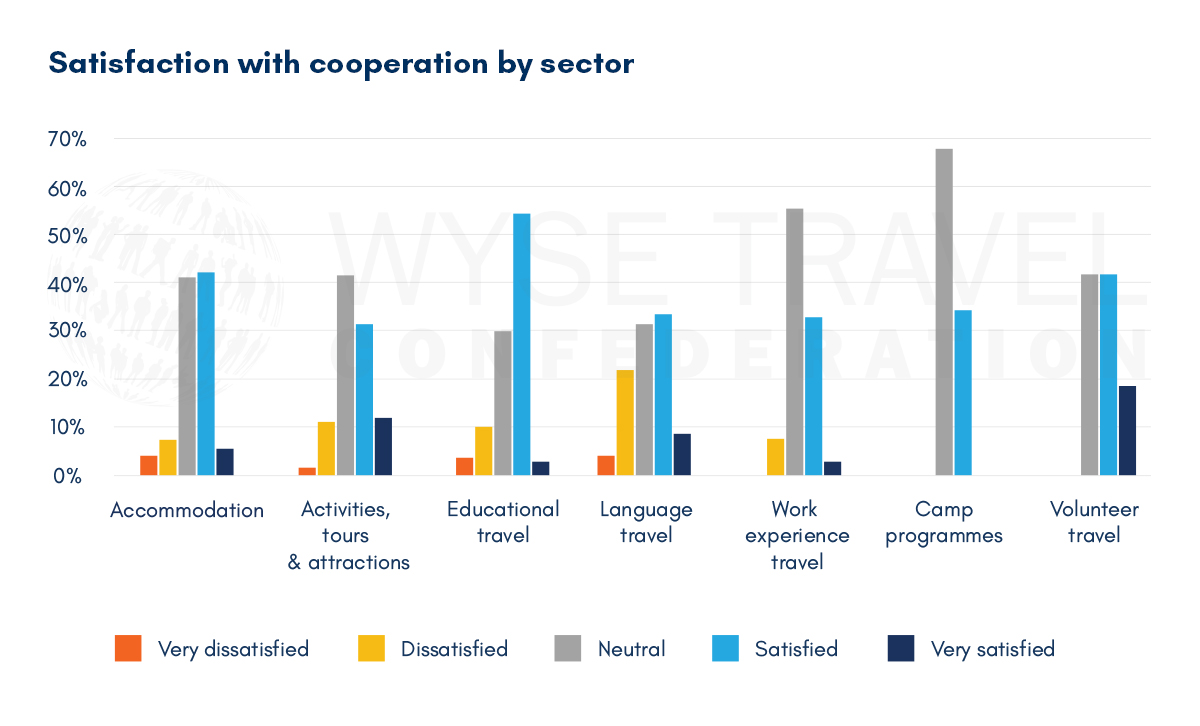

Levels of satisfaction with business cooperation were highest in the volunteer and educational travel sectors.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests, and hopefully soon, new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Series 5–15 June 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature, so to speak. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

May 2020 Travel Business Impact Survey:

Outlook worsens and financial aid is not the only investment governments should make to help travel and tourism

April 2020 Travel Business Impact Survey:

Q2 worse across the globe, but some source markets expecting better for the whole of 2020

Staff cuts, location closures and short survival periods

Satisfaction with COVID-19 cooperation, but placement availability concerns rise

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[1]Data for this report were collected between 1 – 11 May 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire (in English). The survey was the second in a series titled COVID-19 Travel Business Impact Survey. The second iteration of the survey attracted 448 responses from 71 countries. Three-hundred and forty-seven responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys. New questions related to government action, types of financial assistance and potential trends were added to the third iteration of the survey. The profile of respondents to the second survey in May 2020 was similar to that of respondents of the second survey in April 2020, with there once again being relatively fewer responses from language and educational travel providers and more responses from providers of accommodation and activities, tours & attractions. When comparing the May, April and March survey respondents, there has been a slight decrease over time in the level of youth travel specialisation of respondents, going from 69% in March of doing 50% or more of their business in youth travel down to 60% in May.