Findings from WYSE Travel Confederation’s COVID-19 business impact survey[1] indicate travel businesses are anticipating a 30% drop in business for this year. Based on this, the estimated decline in receipts for the youth travel industry could equate to 87 billion euros in 2020.

Overall outlook and average decrease in business

More than 80% of businesses believe that their business prospects will be worse over the coming year.

On average, a 26% drop in demand for business in Q1 2020 compared to the same period last year was reported by respondents across all sectors. Looking ahead to the rest of the calendar year, respondents anticipate, on average, a 30% drop in business volume.

There was no significant difference between businesses specialised in youth travel [2] and other travel businesses in terms of business decreases reported and the outlook for the rest of the calendar year. The average change in volume anticipated for 2020 is 30% for both youth travel specialists and non-specialists. Youth travel specialists reported a slightly lower decrease in demand (24%) for Q1 2020 vs the same period in 2019 than did non-youth travel specialists (30%).

Concerns

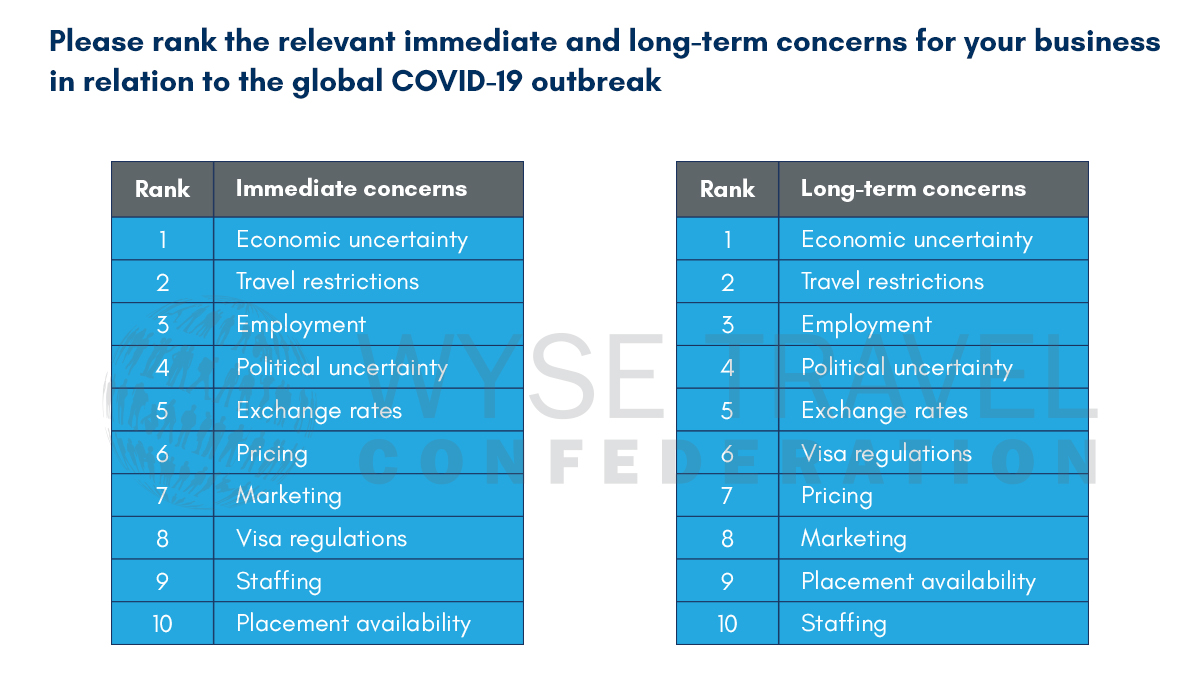

The top five concerns for businesses are the same for the immediate and long term and relate to fairly broad issues such as economic and political uncertainty and travel restrictions. Visa regulations, pricing, marketing, staffing, and the availability of placements are longer-term concerns for businesses.

Actions

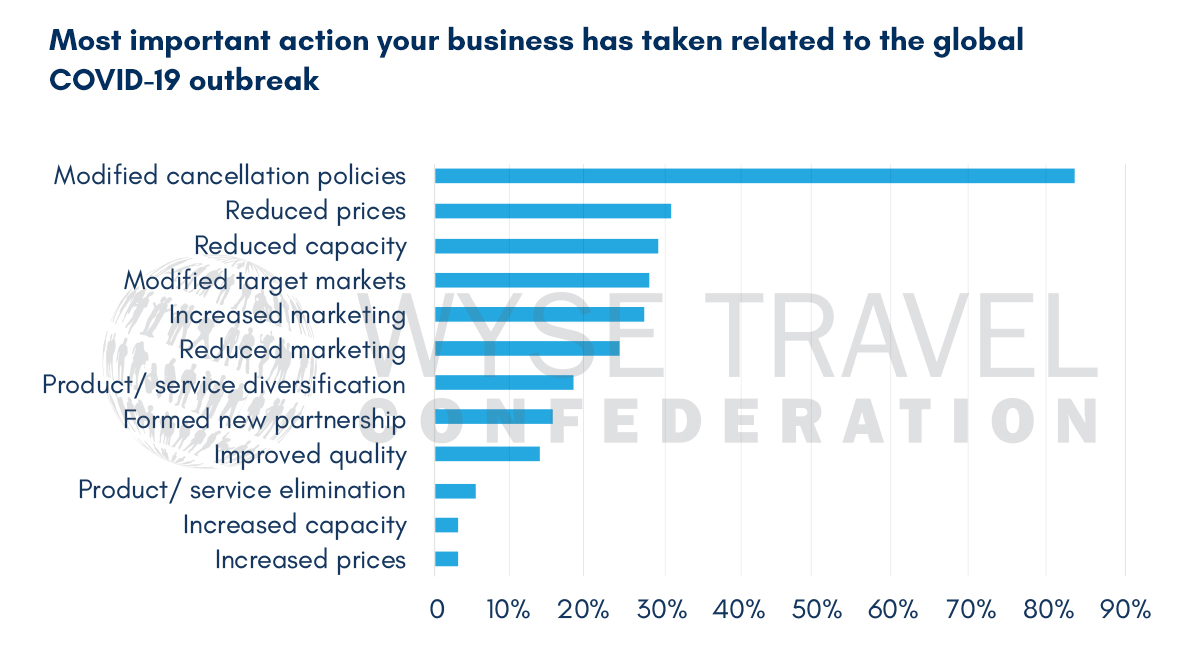

The most important action that businesses reported taking in relation to the global COVID-19 outbreak was, by far, the modification of cancellation policies. Reducing prices and capacity followed in importance. Improving quality, forming new partnerships and adjusting marketing and product offering seem to have lower priority for businesses right now. In particular, several respondents mentioned a shift in marketing to local or regional domestic markets. Not surprisingly, increasing prices and capacity are not actions being utilised by many at the moment.

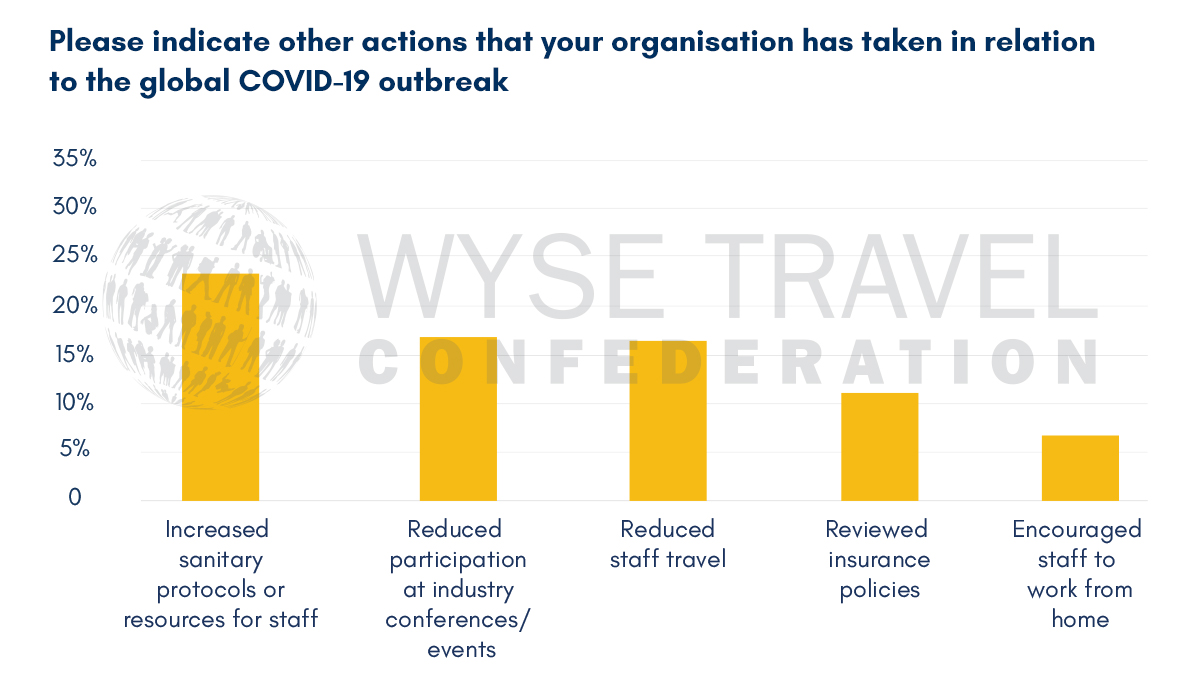

Other actions relate to personnel and internal business operations such as increased sanitary protocols or resources for staff, reducing travel and industry conferences/events. Encouraging staff to work from home and reviewing insurance policies were reported by fewer respondents.

Additional measures that respondents mentioned included the formation of crisis management teams, administering daily briefings, and streamlining policies and protocols with partners.

Interested in more on COVID-19 and youth travel?

WYSE Travel Confederation will be publishing more findings from its COVID-19 Business impact survey in the coming weeks. If your business would benefit from regional, sector and programme-specific analyses, consider joining the global community of youth travel specialists for free access to our research publications.

To read the March 2020 survey analyses, please use the below links:

Business outlook by youth travel sector

Looking back in order to see ahead

[1] Data for this report were collected between March 3 – 9, 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire (in English) titled Business impact survey – COVID-19. The survey attracted 599 responses from 73 countries. Four-hundred and twenty-one responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products. All respondents were asked about the impact that the global COVID-19 (Coronavirus) outbreak has had on their core business in travel. Specific questions related to the change in business demand experienced in Q1 2020 vs the same period in 2019, the business outlook for the coming calendar year, top concerns for the immediate and long term, actions taken in response to COVID-19, and the impact of COVID-19 on group business.

[2] Fifty percent or more of business is focussed on the youth travel segment. Youth travel is defined here as travellers aged 15 to 29.